GOTW | MYOB Essentials: File GST Returns

"Tips on GST return setup and processing..."

MYOB Essentials has the ability to lodge GST returns straight to the Inland Revenue Department with a few simple mouse clicks. This is a time-saving feature to make the GST return process even easier.

Preparing the GST Return in MYOB Essentials

Ensure all of the bank transactions for the GST period have been allocated.

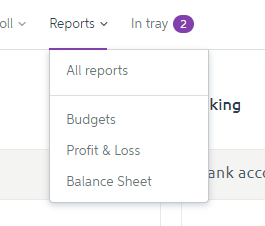

- Select the Reports menu

- Select All Reports

- In the Business reports section of the Reports page, there are three sections to look at during the GST preparation

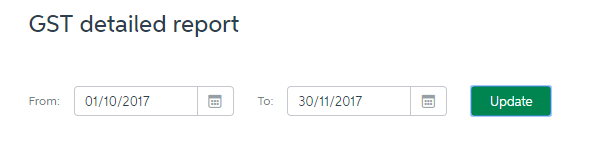

a) GST detailed report

- Review this report first as it shows the detail of the transactions that are going to be included in the GST return. It ensures you have completed the coding correctly and accounted for GST correctly. There is the opportunity to click into incorrect transactions to make adjustment and re-run the report.

- Select the applicable date range when running this report in the From and To fields.

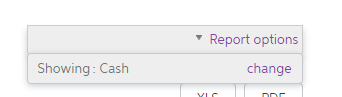

GEEK TIP 1: If you are on Invoice-Basis for GST you will need to click on the Report Options button and select Change to show the report on Accruals Basis

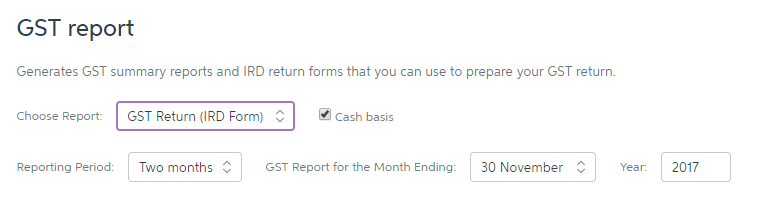

b) GST report

- This report will show the total purchases and expenses for the period and show the total GST refund/payable.

- There is an option to either show a GST Report (Summary) or GST Return (IRD Form)

- If you are on invoice basis you will need to untick the Cash basis checkbox

- Select the Reporting Period e.g. Two months and select the GST period ended e.g. 30 November 2017

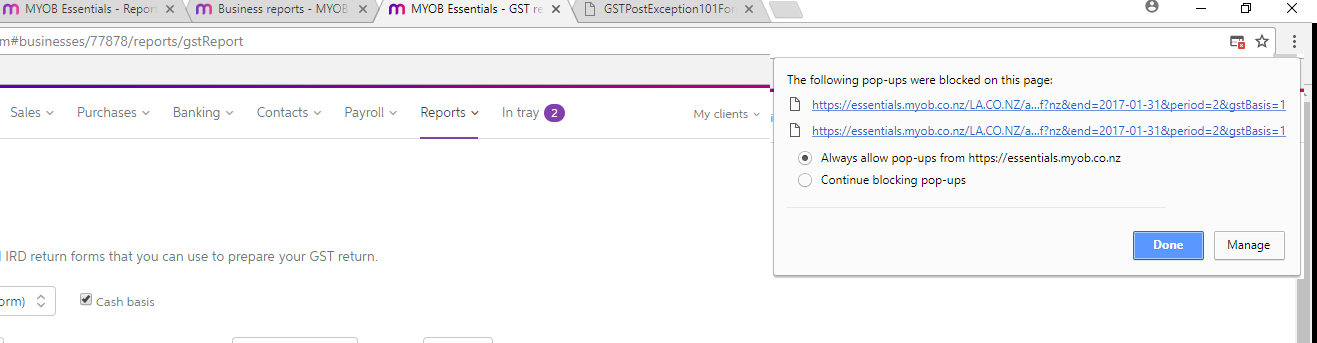

GEEK TIP 2: If you are using Google Chrome as your web browser and you are trying to generate a GST report and nothing is showing, make sure to Always Allow Pop ups for MYOB Essentials. Then try generating the report again.

GEEK TIP 3: Note this report should not be sent to the IRD. If you do not want to use the GST lodgement feature in MYOB Essentials then you will need to copy the amounts from this report onto the GST return form supplied by IRD or by entering the amounts onto the on-screen GST form using your online myIR account.

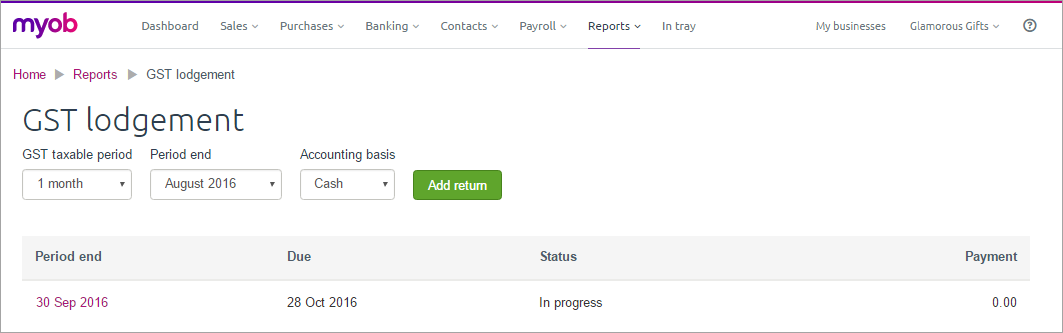

c) GST Lodgement

- After reviewing the GST detailed report and the GST Return you are ready to lodge the return with IRD

- If it's the first time you're lodging your GST return through Essentials, you'll need to enter your login details and click Allow access to allow Essentials to lodge directly to the IRD. The GST lodgement page appears

- If you want to continue working with an existing return, click the date listed in the Period end column

- Or, to start a new return, select your criteria from the GST taxable period, Period end and Accounting basis drop-down lists at the top of the page

- Then click Add return to create the new return

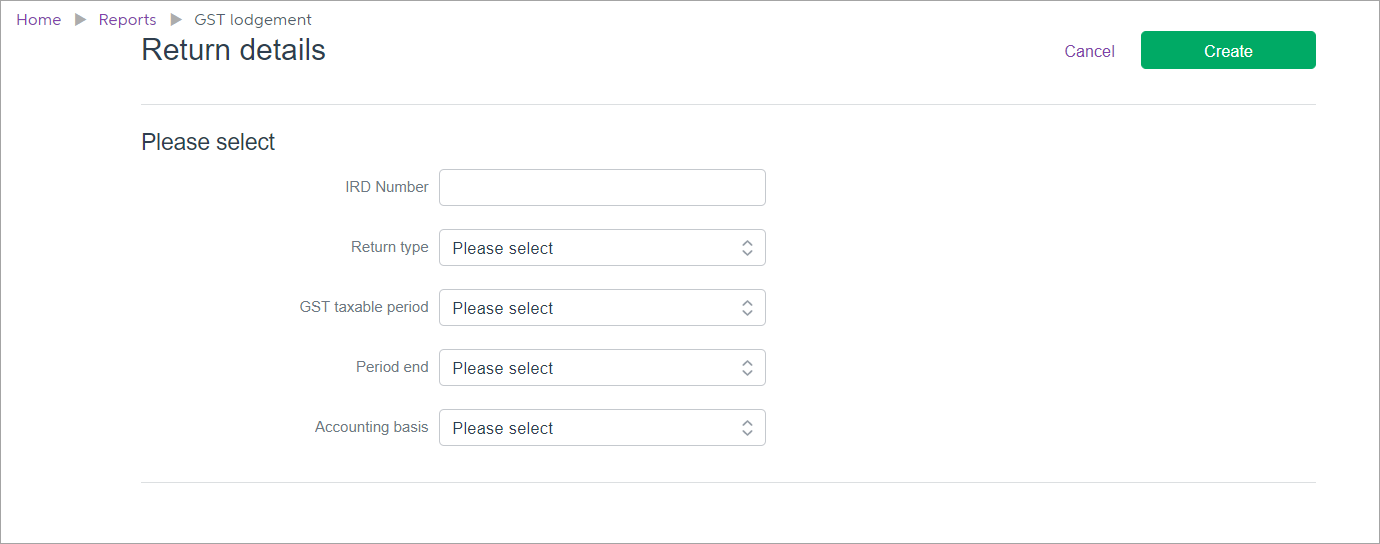

- The Return details page appears

- Enter your IRD number

- Select the Return type, GST taxable period, Period end and Accounting basis. Note that the 6-month GST taxable period option is not yet available.

- Click Create

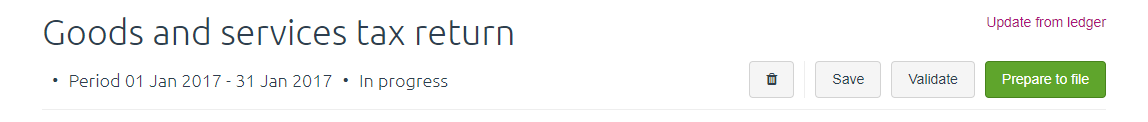

- The Goods and services tax return page appears, pre-filled with the amounts from MYOB Essentials (these amounts will match the GST return report generated earlier)

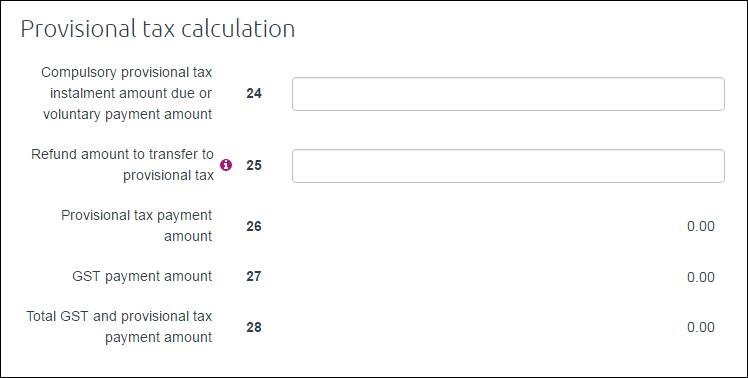

- If you are working with return type GST103, you will need to enter information in fields 24 and 25

- If you need to correct any amounts on the return, click in the fields and type the new amounts

- When you're happy with the return, click Validate to check the figures.

- You'll need to fix any errors before you can lodge the return

- Once the return is validated and you don't want to make any more changes, click Finalise

- The status will display Completed meaning the return is now ready to be lodged with Inland Revenue

- When you're ready to lodge your GST return with Inland Revenue, click File

- A pop-up will appear confirming the filing

- Click Confirm, and you'll be taken to the IRD website

- Enter your myIR user ID and password

- Click Authorise to complete the filing

- You will be directed back to the GST Lodgement screen in MYOB Essentials and it will confirm that return has been filed with IRD

GEEK TIP 4: Print or save the GST Lodgement receipt so you always have record of the return being filed and the amounts that were filed.

If you need any assistance with the GST Return process in MYOB Essentials or have any further questions….

Please contact our in-house guru, Kate

http://www.bwr.co.nz/contact-us#itdept

06 873 8037