GOTW | Creating a myIR account

"Get things done online and on-time with an IRD myIR account..."

With all of the technology changes in the online world, there are many tools available that assist in speeding up processes and increasing the use of electronic systems. GST and PAYE returns can now be filed online with IRD. Many online accounting software now generate GST returns automatically based on the bank reconciliations that you complete. Once you have processed and reviewed your GST return you can even push the return straight to the IRD with a click of the button. You no longer have to manually fill out a paper return and post it to the IRD, keeping your fingers crossed that it will make it there on time. Using online accounting software even eliminates the need to go into the IRD website separately to fill in the online GST return form as it pushes the GST return straight through using the myIR portal. To gain these efficiencies you first need to create a myIR account.

A myIR account lets you manage all your Inland Revenue matters online:

- Update address or bank details

- Work out income tax filing options

- File GST returns

- File PAYE returns

- Check and read eDocuments

- Check your KiwiSaver account

- Check your Student loan account

- Look at Working for Families Tax Credits

Who can have a myIR account

- Individuals with a personal IRD number

- Sole traders operating under a personal IRD number

- Business Owners (Employees cannot register on behalf of a business for security reasons)

GEEK TIP 1: Executive office holders (EOH) can create a myIR account on behalf of their employer or organisation. Follow the link below to download the IR401 form to appoint an EOH.

http://www.ird.govt.nz/forms-guides/number/forms-400-499/ir401-form-executive-office-holder.html

GEEK TIP 2: Have the following ready when registering for a myIR account

- IRD number

- Personal Details (First name, last name, date of birth)

- Contact phone number

- Email address

- Valid NZ mobile number

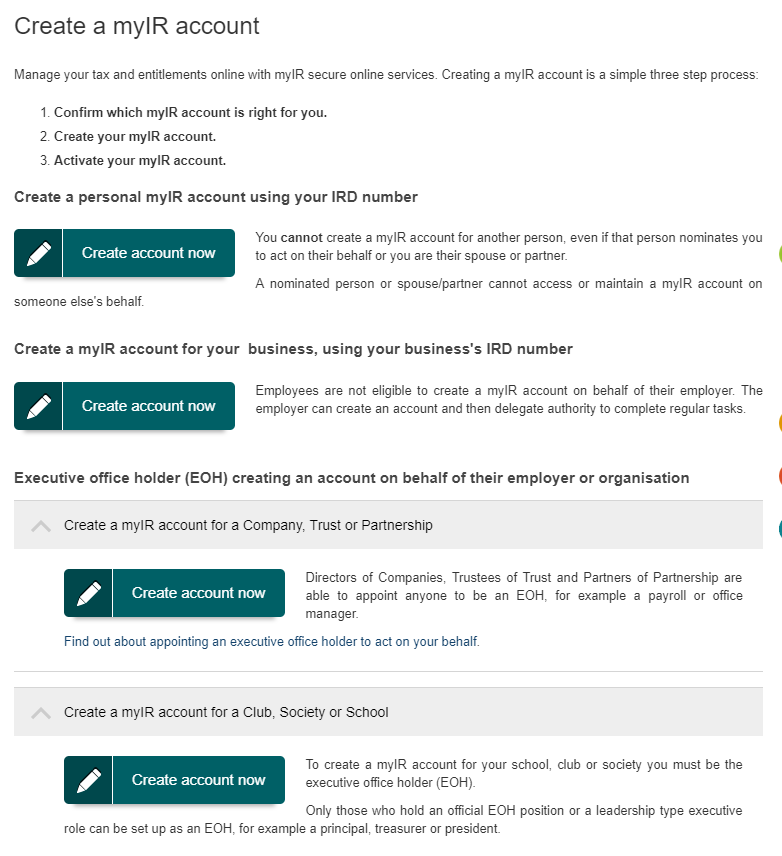

Setting up a myIR account:

1. Follow the link below to the IRD website

http://www.ird.govt.nz/online-services/myir-secure-online-services.html

2. Select Register for myIR

3. Select Create account now and choose whether you are:

a. Creating a personal myIR account using your IRD number

b. Creating my myIR account for your business, you will use the business’s IRD number

c. EOH from Geek Tip 1 can create accounts for a Company Trust or Partnership

d. EOH from Geek Tip 1 can create accounts for a Club, Society or School

4. You will be prompted to enter your IRD number or your business IRD number

5. Select Continue

6.The next screen will require personal details to be entered:

a. First name

b. Last name

c. Contact phone number

d. Email address

e. NZ mobile number which can be used to activate your account

7. Create a User ID and Password (remember to make note of this)

8. Select Continue

9. You will now need to Activate your account

10. If you entered a valid mobile number you will receive an activation code by text which you can enter into this next screen and click Submit (this will need to be done within 2 hours)

11. Alternatively select Exit Process and call IRD on 0800 227 770 to activate your account (Have your IRD number ready)

12. You are ready to use myIR!

If you need any assistance or have any further questions….

Please contact our in-house guru, Kate

http://www.bwr.co.nz/contact-us#itdept

06 873 8037