GOTW | Cloud Accounting Software Addon – Receipt Bank

"One of the most popular accounting software add-ons available"

Receipt Bank is invoice scanning software and is one of most popular options on the market. It uses artificial intelligence to extract key data from your business documents and publishes this straight into accounting software such as Xero or MYOB. Receipt Bank was developed with the aim of saving business owners time and money. Receipt Bank is a fully web based program so can be accessed anywhere, anytime, on any device that has an internet connection. Receipt Bank makes going paperless easy!

Key Features

Say goodbye to PAPER

Gone are the days of having piles of invoices on your office desk creating a mountain until the dreaded 20th of the month rolls around and suddenly it’s a mad rush to make payments to suppliers. Receipt Bank eliminates the need to print out all of the invoices that are emailed. You can send documents straight from your emails. Receipt Bank holds onto your documents forever. It stores them as archived so can be accessed at any time they are needed.

Extract Key Information straight from your document

When documents are uploaded into Receipt Bank it takes a digital image on your document. Key information is extracted straight from the document and processed. Key Information includes:

- Document Type (Receipt, invoice, credit note etc...)

- Date

- Supplier

- Invoice Number (where applicable)

- Currency

- Total

- GST

File Types Supported

- JPEG

- PNG

- GIF

- BMP

- TIFF

- PDF (can handle multiple)

- ZIP

- DOC

- HTML

How to Submit Documents

- Email: Every Receipt Bank user is automatically provided with a unique, personalised @receipt.me email address. Using the unique email address, you can email your bills, invoices and receipts straight to Receipt Bank for processing. Even better, if you have suppliers that you deal with on a regular basis you can provide them with your Receipt Bank email address so they can send documents straight to Receipt Bank for processing

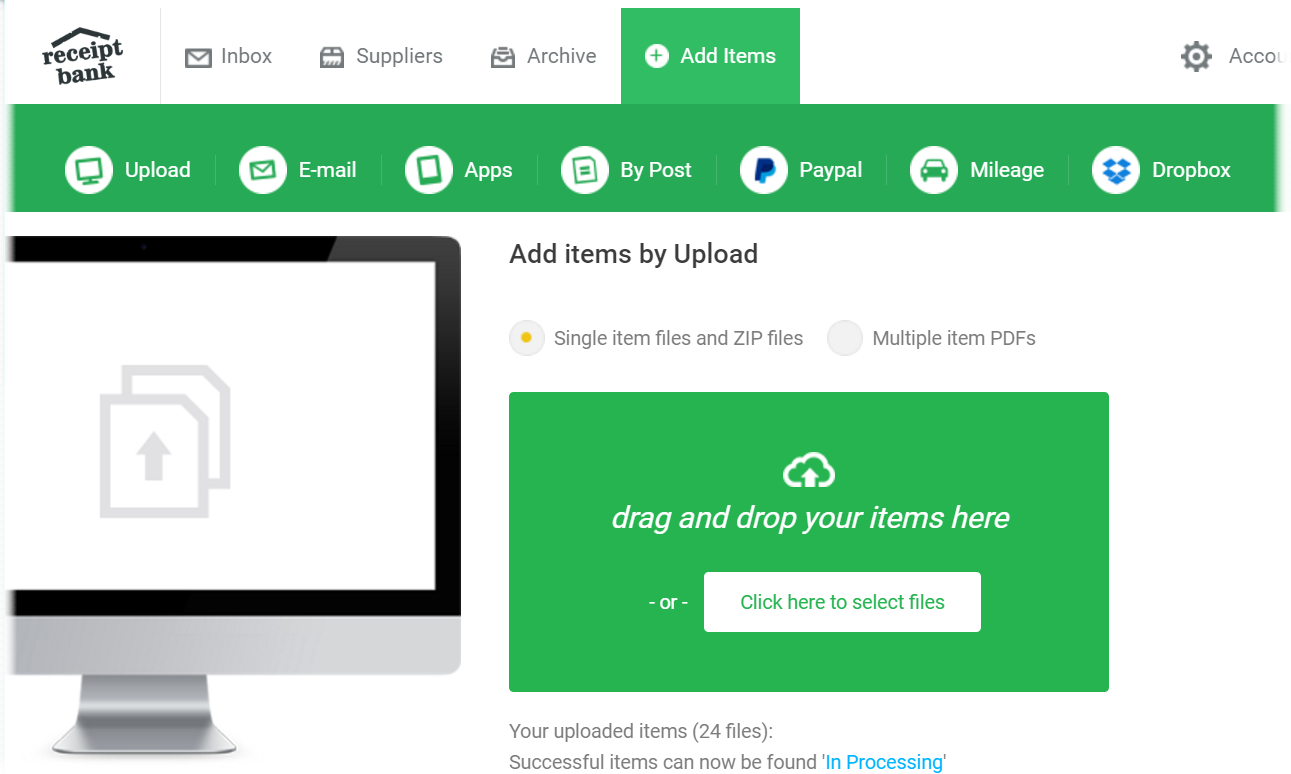

- Upload documents straight from your computer: Documents can be uploaded directly into Receipt Bank using the Add Items button from within the software

- Receipt Bank mobile app: The mobile app is the best way to get your documents in when you’re out and about. It is available on both iOS and Android. Submitting documents is as easy as taking a photo on your mobile device and submitting to Receipt Bank through the app

Processing Timeframes:

After uploading documents, the In-Process tab will give you an estimate of how long processing will take. The time estimations are based on how recognisable the information on the document is. Receipt Bank allows for 24 hours to process but must of the time it is much much faster than this. On average processing time is around 6 hours. The long processing times are to ensure maximum accuracy of the data on the document is extracted.

It gets smarter the more you use it

The more you use Receipt Bank the smarter it gets. Similar to Xero, when coding certain suppliers or line items to the same chart of accounts code, it will remember this and try to automatically code similar documents to the same place. You still have the control to review this and override the code if necessary.

An even better feature is the ability to set supplier rules. These can be setup to code future documents from these suppliers to an account code automatically. Once supplier rules are setup, these can be applied to all documents that are currently showing in the Receipt Bank inbox.

Smart Split

This is a relatively new feature to Receipt Bank. It is quite common to require more than one chart of account code that makes up the document. Smart Spilt allows you to spilt the transaction into multiple account codes.

Pricing

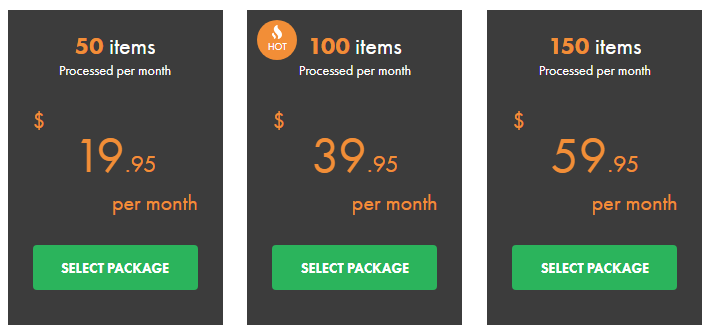

Single user Plans

These plans are ideal for sole traders where only one person requires access to upload documents.

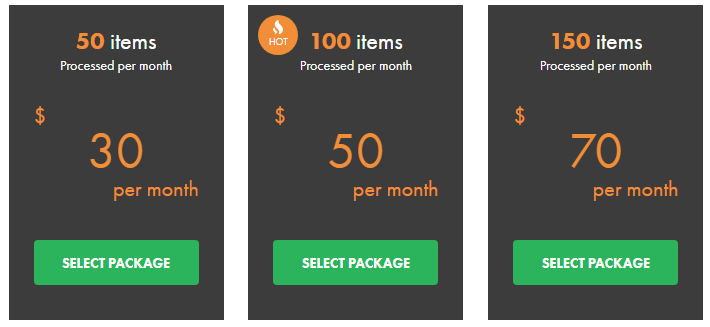

Multiple user Plans

These plans are most suitable for small – medium sized businesses where more than one person will require access to upload documents.

Cloud Accounting Software Integrations:

Xero

Receipt Bank was voted Xero’s add on of the year for the past three years running. Integrating Receipt Bank and Xero is easy. Once documents have been processed in Receipt Bank and key data extracted and processed, it can be exported straight into each of the three Xero sections:

- Purchases: Purchases made by business using company funds

- Expense Claims: When an employee requires reimbursement for items purchased using personal funds

- Bank Account: When working with a Xero cashbook database items are exported here ready to be reconciled

MYOB

Receipt Bank can also integrate with MYOB AccountRight in a similar way to Xero. Receipt Bank does not currently integrate with MYOB Essentials but this is in development. Just like Xero, once documents have been processed in Receipt Bank and key data is extracted and processed, it can be exported straight into one of the two MYOB AccountRight sections:

- Purchases: Purchases made by business using company funds

- Bank Account: When working with a cashbook database, items will be exported here ready to be reconciled

Examples of Receipt Bank in action

- Purchase items online – Forward the invoice to Receipt Bank for processing, go to Xero or MYOB and match the invoice in the bank reconciliation

- Purchase petrol at a service station – Use the Receipt Bank mobile app to take a photo of the receipt from within the app and upload for processing. The paper receipt can now be thrown away. When the bank feed comes through the next morning it can now be matched to this transaction

Conclusion

Using Receipt Bank is intuitive to work with and user friendly. Receipt Bank’s goal is to save each user 1 hour per week from the unnecessary task of entering information into Accounting Software manually. 1 hour is the minimum time saved and in most cases, this is more like 2 – 4 hours per week. 1 hour might not sound like much but what else could you be doing with that hour? Time saved can be better spent growing your business or getting some free time back.

The best way to decide whether Receipt Bank is right for you, is to make use of the FREE, no obligation 14-day trial which you can get here...

Better yet, contact our in-house guru Kate for a free demo of the time savings Receipt Bank can offer your business.